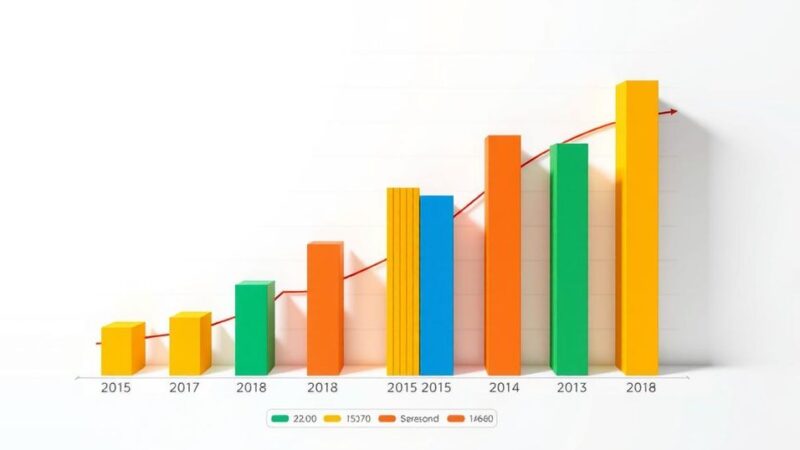

In December, Mozambique’s Net International Reserves rose to $3.740 billion after two months of decline, the highest since September. This increase follows significant reductions in October and November. Governor Rogério Zandamela affirmed that reserves are sufficient but should not be excessively utilized. Businesses have requested changes in mandatory reserve ratios, which were recently adjusted to promote economic liquidity.

Mozambique’s Net International Reserves (NIR) experienced a noteworthy increase in December, reaching $3.740 billion (€3.453 billion), the highest level since September. This growth came after two consecutive months of decline, during which reserves fell to €3.682 billion in October and November, as reported by the Bank of Mozambique’s official data consulted by Lusa.

At the conclusion of September, Mozambique’s NIR totaled $3.762 billion (€3.474 billion), sufficient to cover approximately three months of import needs. The reserves, crucial for facilitating international payments for goods and services, reached nearly €3.601 billion (€3.325 billion) in January 2024, representing the highest figure since September 2021. Notably, in July, reserves peaked at €3.807 billion (€3.515 billion), marking a three-year high.

Rogério Zandamela, the Governor of the Bank of Mozambique, emphasized on November 8 that the country’s foreign currency reserves remain adequate but should not be excessively used. He stated, “We won’t burn reserves and we’re not burning reserves,” reflecting the bank’s outlook on medium-term economic conditions in Maputo, while reassuring that reserves will support normal operations for the nation and its institutions.

Amidst constraints on foreign currency in the domestic market, local businesses have expressed concerns regarding the central bank’s mandatory reserve requirements. The mandatory reserve ratio for foreign currency deposits was set at 39.5%, as opposed to 11.5% in 2022, leading to calls for easing these measures. Subsequently, on January 27, the Bank of Mozambique’s Monetary Policy Committee (CPMO) reduced mandatory reserve ratios to 29.00% for national currency and 29.50% for foreign currency to enhance liquidity and bolster economic recovery and supply chains.

In summary, Mozambique’s Net International Reserves saw a recovery in December, totaling $3.740 billion and marking the highest level since September. The reserves, essential for international payments, faced declines in the preceding months but have shown resilience. The Governor of the Bank of Mozambique conveyed confidence in the adequacy of reserves, while local businesses called for adjustments in mandatory reserve requirements to alleviate currency scarcity. A recent reduction in reserve coefficients aims to facilitate increased liquidity to support the economy.

Original Source: clubofmozambique.com