Scotiabank has agreed to transfer its banking operations in Costa Rica, Colombia, and Panama to Davivienda, receiving a 20% ownership stake in the combined entity. The deal is projected to result in an after-tax impairment loss of CAD 1.4 billion, but aligns with Scotiabank’s focus on operational efficiency in noncore markets. The transaction will bolster Davivienda’s assets to approximately $60 billion and establish a mutual referral agreement between the two banks.

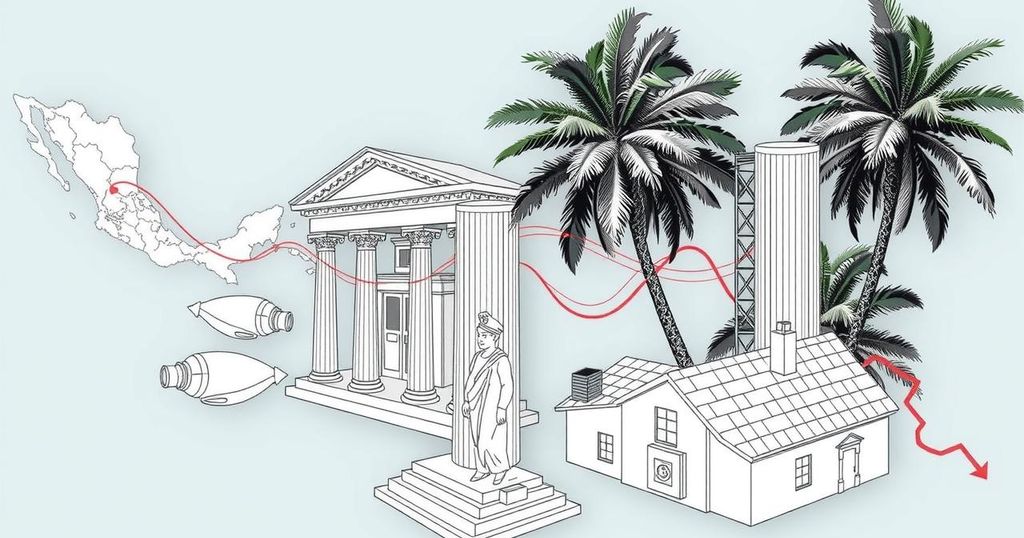

Scotiabank has finalized an agreement to transfer its banking operations in Costa Rica, Colombia, and Panama to Davivienda, a prominent financial institution in Latin America under the ownership of the Bolívar Group. Scotiabank characterized the transaction as “capital neutral overall with potential upside to earnings in future years,” highlighting its receipt of an estimated 20% equity stake in the merged entity led by Davivienda on a pro forma basis. As a result of this agreement, Scotiabank will have the right to appoint board members proportional to its ownership stake, reflecting its interest in the ongoing operations.

Additionally, this deal entails Scotiabank’s classification of the involved operations as “held for sale” from an accounting perspective, resulting in a projected after-tax impairment loss of CAD 1.4 billion (approximately $1 billion) anticipated in the first quarter of 2025. While awaiting regulatory approvals, which are expected to take no longer than 12 months, the transaction will include Mercantil Colpatria’s divestiture of its interests in Scotiabank Colpatria in Colombia. Scotiabank, managing assets amounting to about $1.4 trillion, indicated that the agreement fits within its framework for enhancing operational efficiency in non-core markets and is consistent with its strategic emphasis on building a connected value proposition centered on client primacy in growth markets throughout North America and Latin America.

For Davivienda, which boasts approximately 24.6 million clients and operates over 660 branches along with more than 2,800 ATMs across Latin America, this acquisition is poised to increase its total assets to around $60 billion. Furthermore, Scotiabank and Davivienda will establish a mutual referral agreement, allowing Scotiabank to continue delivering services pertaining to corporate, wealth, and global banking management across all of Davivienda’s operational territories.

The agreement represents a strategic maneuver by Scotiabank to refine its focus and consolidate efforts in core markets while divesting from its banking operations in noncore regions. The transaction aligns with global banking trends, where financial institutions seek to bolster their operational efficiency and reinforce their presence in competitive markets. Davivienda’s acquisition enhances its market position, potentially making it a stronger player in the regional banking industry.

In summary, the transfer of Scotiabank’s operations in Costa Rica, Colombia, and Panama to Davivienda signifies a calculated step towards optimizing banking operations and reinforcing stakeholder interests. The transaction aligns with Scotiabank’s strategic goals while enabling Davivienda to enhance its market reach and asset base, thus paving the way for future collaborative opportunities between the two institutions.

Original Source: www.fintechfutures.com