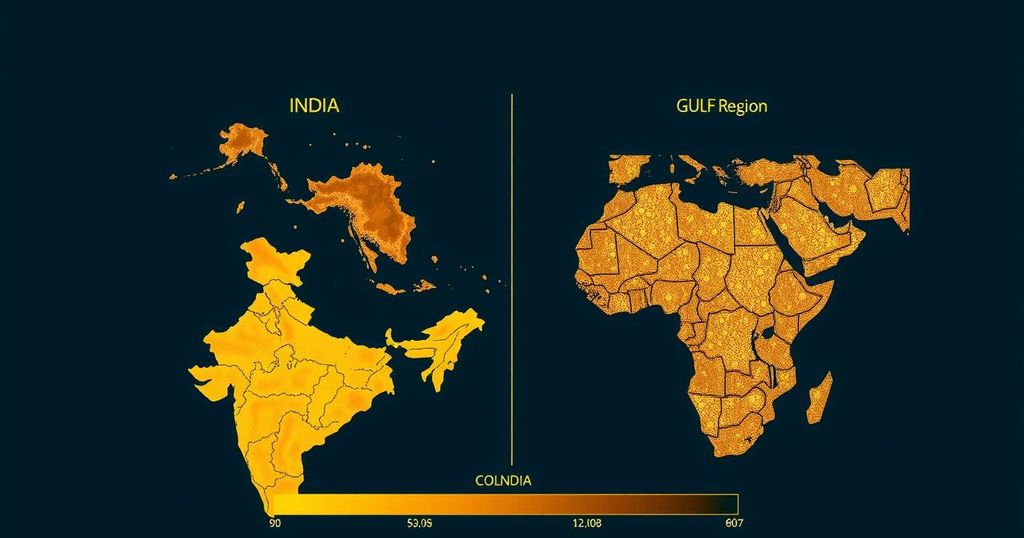

Gold prices in India are cheaper compared to Oman, UAE, Qatar, and Singapore. This disparity is largely due to geopolitical tensions in the Middle East, which have driven up demand and prices for gold in those regions. In contrast, India has seen a decline in gold prices, mostly in line with recent global market trends.

Recent reports indicate that gold prices in India are currently lower than those in Oman, the UAE, Qatar, and Singapore. This trend is attributed to heightened geopolitical tensions in the Middle East, which have consequently inflated gold prices in those regions. Amid ongoing conflicts, investors have sought refuge in gold as a secure asset, leading to increased demand and rising costs. In contrast, India’s gold prices have fallen, aligning with a global trend where gold has experienced its most substantial decline in three years, with prices dropping approximately 4.5% in the U.S. to around $2,563.25 per troy ounce.

Gold has always been a favored investment, particularly in regions impacted by political unrest. The Middle East’s current instability, especially the conflict involving Israel, has prompted many to invest in gold as a safeguard against economic uncertainty. As a result, gold prices have surged in neighboring countries. Conversely, India has observed a decline in gold pricing, which can provide consumers with a more favorable purchasing environment compared to the high prices prevailing in Middle Eastern markets.

In conclusion, while geopolitical factors have caused gold prices to soar in the Middle East, India currently benefits from lower gold prices, creating an advantageous scenario for domestic consumers. The divergence in pricing is primarily influenced by global market trends, particularly in response to escalating tensions in conflict-affected areas, thereby presenting a unique opportunity for gold buyers in India.

Original Source: www.livemint.com