Brazil’s President Lula faces pressing challenges regarding court-ordered debt payments starting in 2027, with discussions on fiscal strategies needed before the April 2026 budget drafting. The Supreme Court ruling has granted temporary relief, but future liabilities are on the rise, demanding immediate attention and potential amendments to fiscal policy.

Brazil’s President Lula’s administration is facing increasing urgency in addressing court-ordered government debt payments set to begin in 2027. With public finances impacted severely, the government recognizes the necessity for a strategic reevaluation of this issue, particularly before the April 2026 budget drafting. Analysts indicate that discussions may need to take place sooner rather than later.

Court-ordered payments initiated by the judiciary before the end of March are included in the following year’s budget, while those issued after April affect the budget two years later. This necessitates timely decisions to appropriately account for these costs during the budget formulation for 2027, sustaining compliance with fiscal regulations.

The Supreme Court ruling in 2023 afforded Lula’s government a temporary reprieve by allowing it to exclude approximately half of these payments from current fiscal limits for three years. This exemption was enacted following a decision to negate former President Bolsonaro’s suspension of these payments, designed to facilitate governmental budgeting.

Yet, the grace period designated by this ruling will conclude in 2026, after which the government must devise a plan to address accumulated debts. In December 2023, R$92.4 billion was disbursed to mitigate further financial obligations from these payments. Hence, there is a strong push from a faction within the administration advocating for either a Supreme Court extension or a new constitutional amendment (PEC).

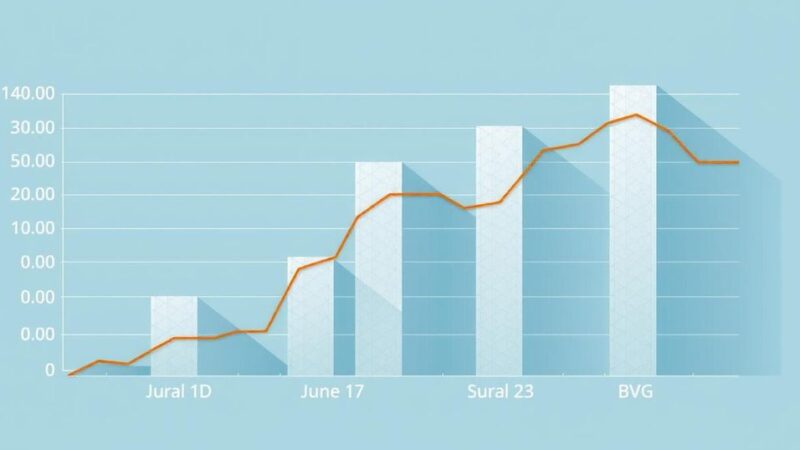

The current budget allocates R$102.7 billion for court-ordered payments and other claims, surpassing analyses from financial markets. Of this, R$44.1 billion remains exempt from fiscal regulations due to the Supreme Court’s ruling. Moreover, government data indicates a continual increase in these court-ordered payments, which climate research firms estimate may surge to R$116.3 billion by 2027.

Since President Lula’s tenure began, collaboration among Finance and Planning ministries and the Attorney General’s Office (AGU) has aimed to alleviate the repercussions of these debts. A pivotal initiative was the establishment of the Council for Monitoring and Managing Fiscal Judicial Risks, which has already reported relative success although challenges persist in addressing the primary fiscal impact; notably, around 43% of these payments stem from pension claims.

In the past two years, the AGU has thwarted R$1.9 trillion in potential losses through favorable rulings in several significant court cases, including rulings on pension recalculations. Legal efforts spearheaded by Attorney General Jorge Messias include structural measures aimed at decreasing adverse court rulings for the government, though these will take time to manifest fully.

The AGU finds that the average waiting time for these payments is eight years, emphasizing that even concerted efforts by the government may not drastically reduce such liabilities in the near term. Thus, initiatives are being launched to facilitate pre-court settlements and better evaluate litigation risks, particularly concerning substantial lawsuits anticipated in the sugarcane and ethanol industries.

A debate has arisen among government factions regarding the financial categorization of court-ordered payments amidst evolving fiscal strategies. While some suggest classifying only the principal as primary expenditure, others wish to encompass the entire amount, excluding it from certain cap calculations.

Experts emphasize the necessity to devise a solution by 2027, as the upward trajectory of these payments poses a significant fiscal dilemma. Opinions diverge between expecting a Supreme Court extension or necessitating a fiscal framework revision post-2026.

Proposed options include drastic spending cuts to better integrate court-ordered payments into the budget while adhering to fiscal targets; however, significant adjustments regarding constitutional spending limits and pension reforms will be required. The administration must confront the fiscal challenges head-on, especially given the economic difficulties faced during Mr. Bolsonaro’s last administration and ongoing issues that the Lula administration has yet to resolve.

Finance and Planning ministries have declined to comment on these matters, but the overarching consensus is clear: proactive measures are imperative to ensure Brazil’s economic stability in the forthcoming years.

In conclusion, Brazil’s government is grappling with imminent court-ordered debt payments set to impact the fiscal landscape beginning in 2027. The urgency of addressing this issue is underscored by preliminary budget demands for 2026, necessitating immediate strategic discussions. As projections indicate a significant rise in these debt payments, efforts to negotiate extensions and re-evaluate fiscal frameworks become critical. Ensuring fiscal stability will depend on proactive engagement from the Lula administration in collaboration with key governmental bodies.

Original Source: valorinternational.globo.com