Egypt’s core inflation dropped to 10% in February 2025, down from 22.6% in January. CAPMAS reported a decrease in urban monthly inflation to 1.4% and a national annual inflation rate of 12.5%. While some sectors saw price increases, the Central Bank maintained interest rates amid ongoing inflationary risks, projecting a continuing downward trend in inflation for the first quarter of 2025.

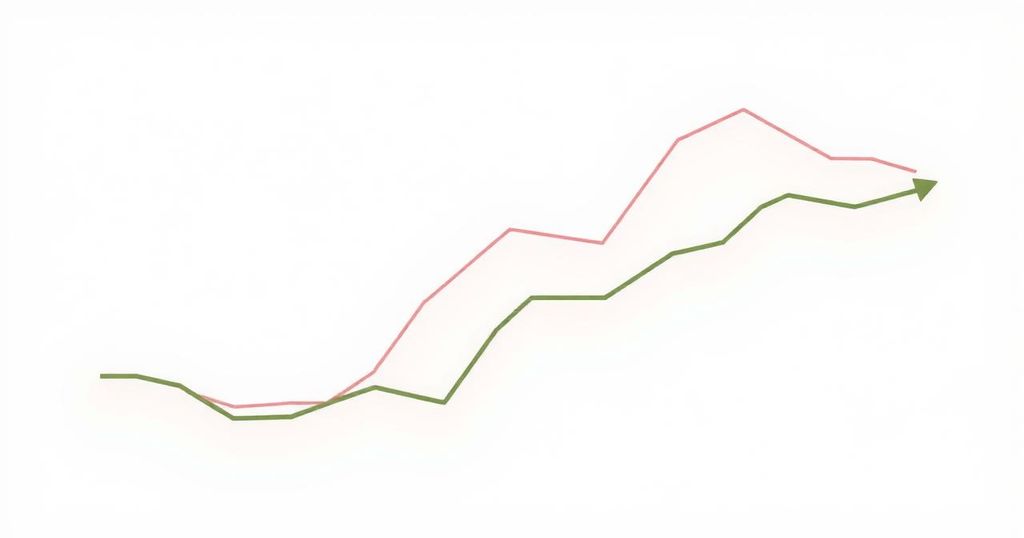

In February 2025, the Central Bank of Egypt (CBE) reported that core CPI inflation decreased to 10%, marking a significant drop from 22.6% in January 2025. Monthly core inflation stood at 1.6%, down from 1.7% in January, illustrating a positive trend in Egypt’s inflationary environment. The decline in annual urban inflation supported this trend, falling from 24% in January to 12.8% in February 2025, primarily due to base-year effects.

The Central Agency for Public Mobilization and Statistics (CAPMAS) noted that the monthly inflation rate in urban areas eased to 1.4% in February, a slight decrease from 1.5% in January. The consumer price index rose to 246.8 points, reflecting a national annual inflation rate of 12.5%. Contributing to this decline, prices for essential goods, such as vegetables, decreased by 8.2%, while prices for coffee, tea, and cocoa dropped by 0.2%. Stability in prices for water and various fuel sources also supported lower inflation figures.

Nonetheless, certain commodities experienced price increases. Grain and bread prices increased by 0.8% and meat and poultry prices rose by 3.2%. Other notable price increases included dairy products at 0.7%, and fruits at 3.0%. Meanwhile, tobacco prices rose significantly by 6.3%, alongside various household and medical expenses, indicating persisting inflationary pressures despite overall declines in specific areas.

Housing-related expenses exhibited upward trends, with clothing prices rising by 0.6%. Rental costs for housing increased by 1.1%, along with 0.9% and 0.7% increments in household furnishings and home appliances, respectively. Transport costs mirrored this trend, reflecting increases in medical services and vehicle purchasing costs, which further complicated the overall inflation landscape.

In sectors such as communication, education, and entertainment, postal service fees surged by 2.9%, while costs for educational services saw considerable increases, notably with pre-primary education rising by 12.5%. Despite the positive implications of overall declining trends, the hospitality sector also showed significant price hikes.

As of February 20, 2025, the CBE’s Monetary Policy Committee (MPC) maintained interest rates for the seventh consecutive time, with the overnight deposit rate unchanged at 27.25%. The MPC expressed concern over heightened inflationary risks, citing global economic uncertainties and geopolitical tensions as potential factors adversely impacting inflation trends.

Despite the current challenges, the MPC anticipates a continued downward trajectory in inflation rates driven by previous monetary tightening efforts. However, potential fiscal consolidation measures may slow this decline. The committee acknowledges that ongoing assessments will guide future monetary policy decisions, emphasizing its commitment to restoring inflation within the target range and addressing demand and supply pressures effectively.

In summary, Egypt’s core inflation has decreased to 10% in February 2025, indicating improvements in inflation management amidst various economic pressures. The decline in both monthly and annual inflation rates reflects significant price reductions in several essential sectors. Additionally, while some sectors continued to experience cost increases, the CBE has opted to maintain current interest rates to address inflationary risks. Continued monitoring and appropriate monetary policy adjustments remain essential for sustaining this positive trend in inflation control.

Original Source: www.dailynewsegypt.com