The rapid inflation in Nigeria is pushing citizens towards entrepreneurship, with 31% prioritizing business ventures for short-term savings. A survey reveals that many engage in entrepreneurship not out of ambition but out of necessity, often leading to increased debt. Women show higher ownership rates, and economic challenges drive shifts in financial goals and behaviors.

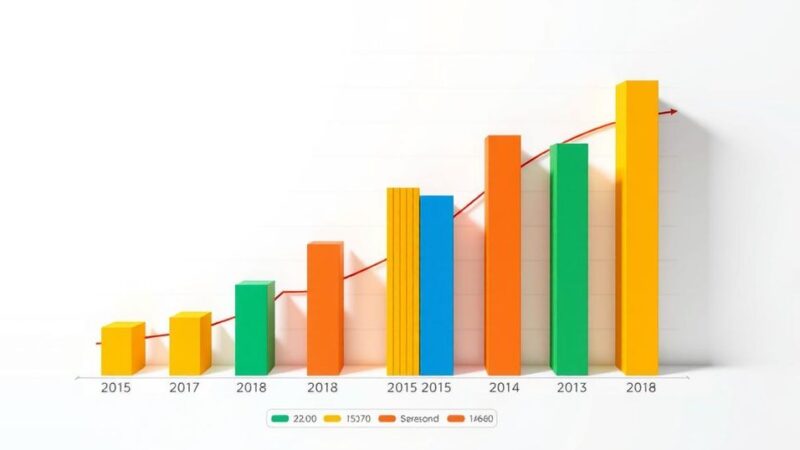

The escalating inflation in Nigeria is driving citizens toward entrepreneurship as a survival strategy. A recent PiggyVest Finance Roundtable surveyed over 10,000 Nigerians, revealing that 31 percent now consider starting a business as their primary short-term savings goal. This trend highlights a shift in economic behavior wherein many feel compelled to pursue entrepreneurship in response to rising costs and reduced purchasing power.

The comprehensive study examined the impact of inflation on various financial behaviors, including income, saving, spending, and debt management. Starting or expanding a business emerged as the second most popular savings goal, with nearly one in four Nigerians incurring debt to finance these endeavors. Notably, 26 percent of Nigerians own a business, with women displaying a higher ownership rate compared to men.

Nigeria’s inflation rate surged to a historical high of 34.80 percent by the end of 2024, further diminishing purchasing power and demonstrating the urgent need for multiple income sources. Economic challenges, such as soaring food prices and currency volatility, have intensified inflationary pressures, prompting consumers and businesses to seek relief.

A recent discussion on X emphasized that many Nigerians engage in entrepreneurship not out of choice but necessity, often as a means to supplement inadequate job income. According to PWC, small businesses represent 96 percent of the economy and contribute significantly to employment and national GDP.

Women are reportedly more inclined to establish businesses, often due to workforce exclusion related to family obligations. This insight was echoed by Ibiyinka Ibru, who noted that many women create micro-businesses primarily for survival rather than expansion.

With economic conditions changing, so do priorities. Eweniyi highlighted that insights from the report inform PiggyVest’s product development, leading to adjustments that respond to individuals’ evolving savings goals. Currently, a marked increase in savings for business commencement and financial independence is evident, which prompted changes in interest rates and the launch of PiggyVest Business to facilitate better financial management for entrepreneurs.

In summary, Nigeria’s soaring inflation has catalyzed a significant increase in entrepreneurship as citizens seek sustainable income solutions. The findings from the PiggyVest survey reveal a collective shift towards business ventures driven by economic necessity. This notable trend underscores the resilience and adaptability of individuals facing challenging financial realities, ultimately shaping the future of entrepreneurship in Nigeria.

Original Source: businessday.ng