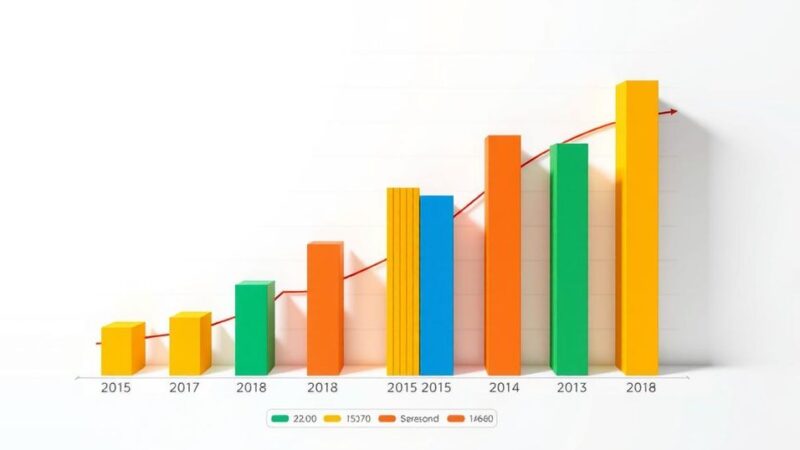

Brava Energia’s stock surged nearly 10% following the release of February’s production data, which showed record output levels due to significant investments and operational improvements. Notably, total production increased by 9.2% from January, with a remarkable 17.9% growth in offshore performance. The company’s positive results made it the leading gainer on Brazil’s Bovespa index, which rose 1%.

Brava Energia, a Brazilian oil company, experienced a significant increase in its shares following the release of production data for February. The company reported record production levels for the month, attributing this success to strategic investments and enhancements in its key operational hubs. Notably, Brava’s total production improved by 9.2% compared to January.

Analysts from JPMorgan pointed out that most of Brava’s fields exceeded performance metrics from prior months. They emphasized the offshore results as particularly impressive, stating that production surged by 17.9%, primarily due to enhanced operational efficiency at the Atlanta field and an increase in output from the Papa-Terra field.

As a result of these positive developments, shares in Brava soared by nearly 10%, positioning the company as the leading gainer on Brazil’s principal stock index, Bovespa (IBOV), which itself rose by 1%.

Brava Energia’s notable rise in production during February, marked by a 9.2% increase and record output levels, reflects the success of its investment strategies. The significant offshore production growth, especially from the Atlanta and Papa-Terra fields, has positively impacted investor confidence, leading to a marked increase in the company’s stock value. Overall, Brava’s performance has rendered it a standout in Brazil’s stock market this month.

Original Source: www.tradingview.com