KCB Group and Bank of Kigali are the first banks in Kenya and Rwanda to adopt the Pan-African Payment and Settlement System (PAPSS), enhancing intra-African trade and financial connectivity. PAPSS, developed by key African financial institutions, simplifies cross-border transactions, allowing faster, cheaper, and secure payments. With the system’s growth since its pilot in 2022, there is potential for substantial economic integration across the continent.

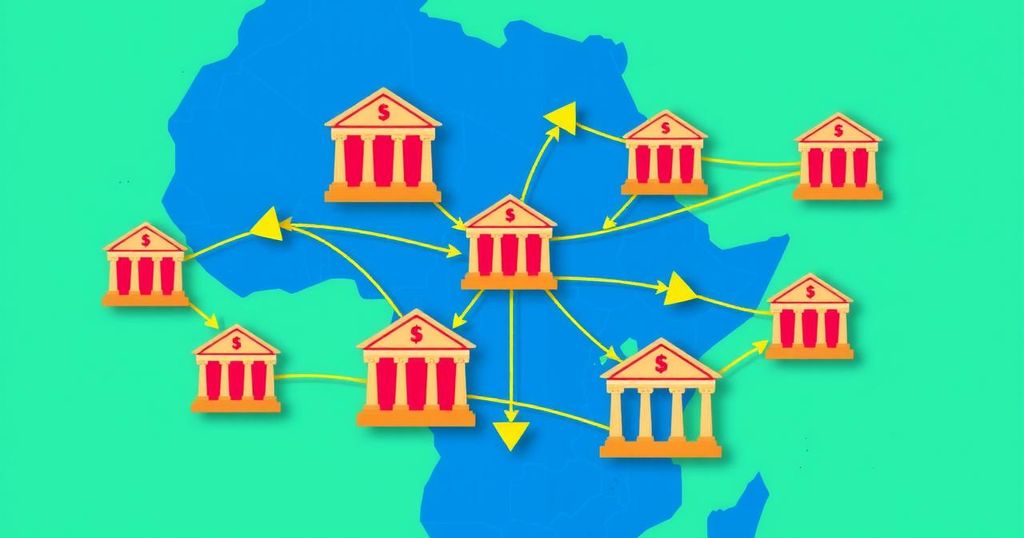

KCB Group of Kenya and Bank of Kigali of Rwanda have become pioneers by integrating into the Pan-African Payment and Settlement System (PAPSS), a significant stride towards enhancing intra-African trade and financial connectivity. PAPSS, initiated by Afreximbank, the African Union Commission, and the AfCFTA Secretariat, eliminates dependencies on third-party currencies and correspondent banks, thereby making cross-border transactions swifter, more economical, and secure.

The launch of PAPSS commenced on February 26 in Kigali by Bank of Kigali, with KCB Group following suit on February 27 in Nairobi. Clients of both banks can now transact across Africa seamlessly using mobile applications and branch networks, enhancing their access to continental markets.

Mike Ogbalu III, CEO of PAPSS, highlighted the system’s benefits, stating that this transformation “unlocks new opportunities for trade and investment, allowing African SMEs to access broader markets and contribute to local economies.” Paul Russo, CEO of KCB Group, expressed a desire to foster trade in Africa, emphasizing the utilization of their digital infrastructure to enhance payments. Dr. Diane Karusisi, CEO of Bank of Kigali, noted the prompt payment capabilities for Rwandan entrepreneurs, making it possible to receive funds instantly in either Rwandan francs or USD from any participating country.

Since its pilot launch in 2022, PAPSS has made notable advances, engaging 15 central banks, over 150 commercial banks, and 14 payment switches. With merely 16% of Africa’s total trade being intra-continental, PAPSS is essential in refining financial processes and accelerating economic integration throughout the continent.

The integration of KCB Group and Bank of Kigali into the Pan-African Payment and Settlement System marks a pivotal moment for enhancing trade and financial transactions across Africa. By facilitating faster and affordable payments, PAPSS aims to bolster economic integration and provide significant opportunities for African SMEs. As the system continues to expand, its impact on intra-African trade practices is expected to be profound.

Original Source: techlabari.com