The Talanx Group issued a $100 million catastrophe bond to secure multi-year earthquake risk protection in Chile through Maschpark Re Ltd. This first-of-its-kind bond, structured with parametric triggers for quicker payouts, enhances Talanx’s reinsurance strategy. The involvement of Hannover Re further solidifies the bond’s foundation in the insurance-linked securities market.

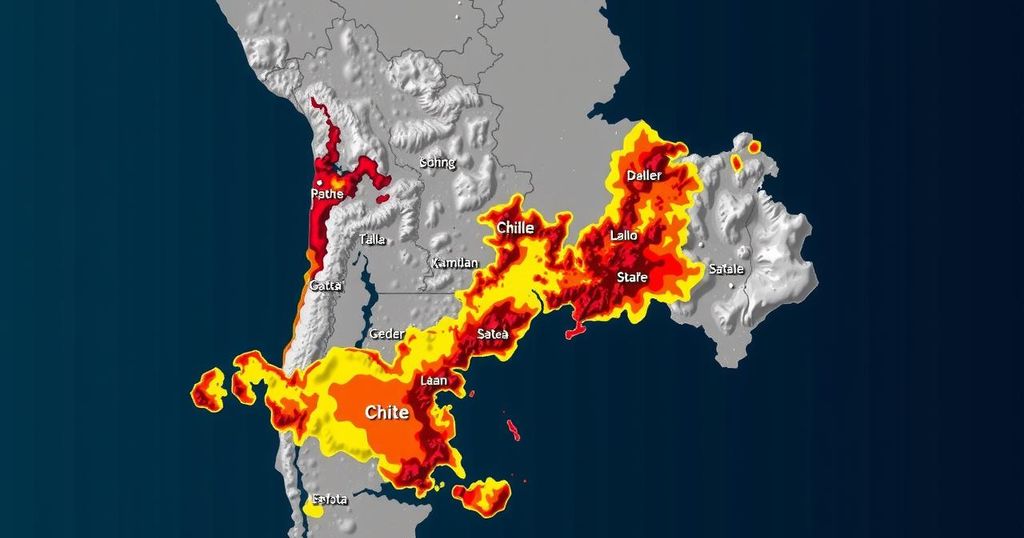

The Talanx Group has announced its successful issuance of a $100 million catastrophe bond aimed at providing multi-year protection against earthquake risks specifically in Chile. This debut bond, facilitated by the Bermuda-based special purpose insurer Maschpark Re Ltd, was developed in conjunction with Hannover Re, a subsidiary of Talanx and a leader in the insurance-linked securities (ILS) sector. Talanx’s Chief Financial Officer, Dr. Jan Wicke, indicated that this bond significantly bolsters the company’s reinsurance coverage in Chile, which remains a critical market for Talanx. The cat bond is structured with a parametric trigger that enables payouts based on earthquake magnitude, aligning with Talanx’s risk management practices in a seismically active region.

Hannover Re’s substantial experience in the field has contributed to the successful structuring of this bond. Silke Sehm, an executive board member at Hannover Re overseeing property and casualty reinsurance, highlighted the company’s extensive background in risk securitization and its commitment to supporting clients across various sectors. This catastrophe bond provides Talanx with essential coverage from January 2025 through December 2027, thereby enhancing its ability to respond to potential seismic threats in Chile efficiently. The issuance of this bond was further supported by Aon Securities LLC and GC Securities, a division of MMC Securities LLC.

Catastrophe bonds are financial instruments issued by insurance companies to transfer risk from natural disasters to investors. They allow insurers to secure upfront capital by offering returns, which depend on the occurrence of specified catastrophic events. The issuance of such bonds has gained prominence as companies like Talanx seek to diversify their risk management strategies, particularly in regions susceptible to natural hazards. Chile, located in a highly seismic area, represents a significant risk for insurers, rendering advanced financial tools necessary for effective risk mitigation. The collaboration between Talanx and Hannover Re exemplifies the growing importance of insurance-linked securities in modern risk management.

In conclusion, Talanx’s issuance of its inaugural $100 million catastrophe bond marks a strategic move to enhance reinsurance coverage against earthquake risks in Chile. Through innovative structures like parametric payouts, this bond not only diversifies Talanx’s risk management approach but also underscores the critical role of insurance-linked securities in safeguarding against natural disasters. The partnership with Hannover Re exemplifies a robust collaboration in navigating the complexities of the capital markets, ultimately benefiting Talanx’s operational stability in a seismic-prone territory.

Original Source: www.insurancebusinessonline.com.au