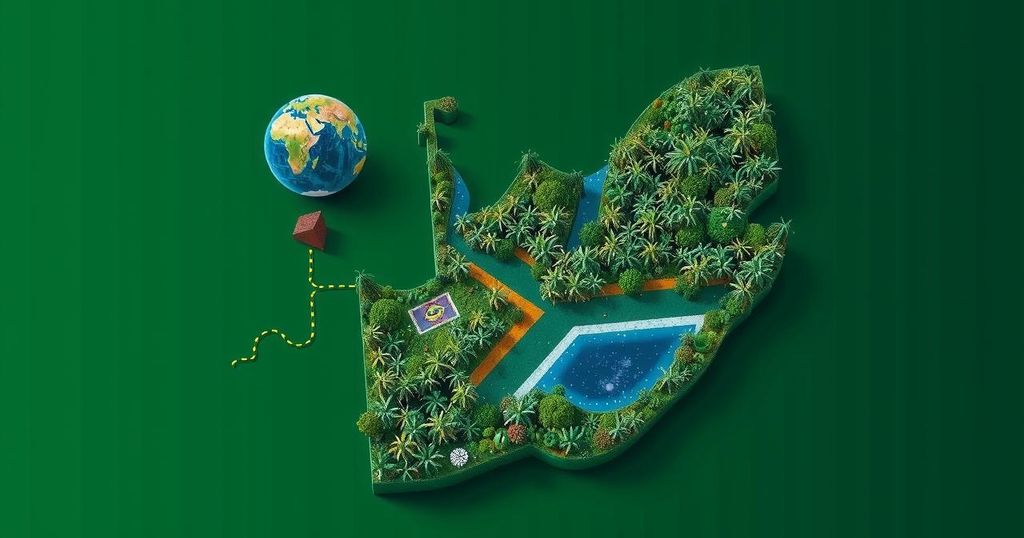

The South African Reserve Bank (SARB) navigates the intersection of climate change and economic stability through three primary strategies: encouraging financial institutions to address climate risks, analyzing the impact of climate change on inflation and financial stability, and implementing greener practices in its operations. Despite its indirect mandate concerning environmental issues, the SARB has acknowledged the significant implications of climate-related risks, advocating for comprehensive impact assessments and greening investments to enhance economic resilience.

Climate change introduces significant economic and social risks that influence the financial system’s operation, which comprises various institutions and markets. The South African Reserve Bank (SARB) addresses these challenges through three primary approaches: promoting the consideration of climate-related risks by financial institutions, analyzing the relationship between climate change, inflation, and financial stability, and adopting greener practices within its operations. In a recent discussion, Fundi Tshazibana, deputy governor of SARB and a leader in financial regulatory efforts, reaffirmed the bank’s commitment to navigating these concerns despite its constitutional mandate not explicitly encompassing environmental responsibility.

Sustainable economic growth, the continuous expansion without cycles of boom and bust, hinges on the careful utilization of natural resources. While the SARB’s primary responsibility is to safeguard the currency’s value, thus indirectly fostering stability in climate-related pricing, it recognizes that environmental factors significantly affect agricultural production costs and insurance premiums, contributing to inflation dynamics. Hence, stable macroeconomic conditions are essential to facilitating investment in sustainability initiatives.

The SARB’s mission statement implicitly includes climate-related responsibilities, acknowledging the critical influence of climate change on price and financial stability. As highlighted by Tshazibana, climate policy is not the main mandate of the SARB, yet the bank must address the economic implications of climate risks. The SARB has long engaged in analytical work on weather-related economic impacts, especially concerning food prices affected by droughts.

Furthermore, the SARB recognizes the necessity for impact assessments across public institutions, advocating for the integration of climate considerations in policy evaluations. With significant analytical output, the bank has explored the nexus of climate change with monetary policies, conducting stress tests of major insurance companies that included climate risk components. Additionally, climate-related discussions with regulated financial institutions culminated in a comprehensive report that outlines risk management practices.

Regarding investment practices, the SARB allows for the acquisition of environmental, social, and governance (ESG) bonds, provided they adhere to existing guidelines for Reserves Management. Recently, the SARB allocated a portion of its foreign exchange reserves to a green bond fund, reflecting an ongoing reassessment of its investment strategies to promote sustainability in line with market conditions.

The intersection of climate change and economic stability has garnered increasing attention among financial institutions worldwide. Central banks, serving as stabilizers of financial systems and inflation control, are tasked with managing the potential disruptions that climate-related risks may pose. The South African Reserve Bank has begun to recognize the importance of these issues, particularly within the context of the country’s susceptibility to climate events and the resultant economic fluctuations that can arise from such phenomena. By aligning their objectives with sustainability goals, central banks like SARB can contribute to a more resilient economy amidst shifting environmental conditions.

In summary, the South African Reserve Bank is actively engaging with the implications of climate change within its operational framework, although its mandate primarily focuses on price and financial stability. By analyzing climate risks, conducting impact assessments, and facilitating investment in environmentally sustainable assets, the SARB is striving to integrate climate considerations into the financial landscape. This pragmatic approach underscores the bank’s recognition of the interconnectedness of economic and environmental health, suggesting that collaborative efforts across governmental institutions will be essential for meaningful progress in addressing these thematic challenges.

Original Source: theconversation.com