Climate resilience in developing countries is endangered by the debt incurred from climate change impacts. To remedy this, taxes on fossil fuels and shipped goods could be established, generating significant funds for loss and damage recovery efforts. Historical precedents indicate that international levies can be effectively enforced, warranting urgent action before further climate-related disasters exacerbate existing vulnerabilities.

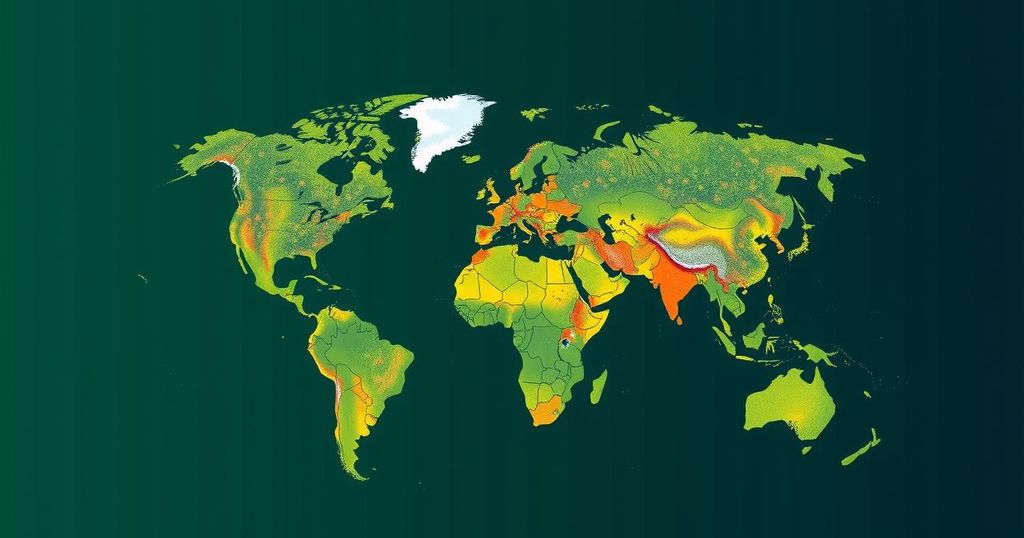

The urgent need to address climate resilience financing has arisen, particularly through the implementation of taxes on fossil fuels and shipped goods. Regions heavily impacted by climate change are becoming increasingly burdened by debt, with developing countries facing losses exceeding $100 billion annually due to climate-related damages, despite contributing minimally to the crisis. To mitigate this financial strain, international tax mechanisms must be established to generate funds for loss and damage claims that will allow for immediate relief and future resilience building.

This issue is exemplified by Hurricane Beryl’s aftermath in Grenada, which prompted the need for a hurricane clause enabling the country to pause debt repayment—a temporary solution that ultimately must be reconciled. As climate catastrophes become more frequent, insurers retreat, leaving vulnerable nations to fend for themselves. Historical precedents for funding through international levies demonstrate that collective action is not only possible but necessary.

For instance, the catastrophic Torrey Canyon oil spill led to the establishment of comprehensive international frameworks such as the International Convention on Civil Liability for Oil Pollution Damage, which mandated compensation for pollution victims from all oil purchasers. Similarly, a modest levy of 0.1 percent on oil transactions in the United States has generated a substantial trust fund dedicated to spill compensation. Therefore, a parallel approach can be applied to greenhouse gas emissions, which create a pressing need to fund climate damage recovery initiatives.

The shipping industry, responsible for transporting 90 percent of global goods, represents an ideal sector to impose a levy based on the value of fossil fuels and other high-emission goods. A proposed 0.2 percent tax could potentially raise $50 billion per year to create a dedicated fund supporting countries most affected by climate-related loss and damage. This initiative calls for the engagement of ministers and international governing bodies to enact these levies, ensuring that developing nations, which have significantly less contributed to the global warming crisis, are not penalized.

In conclusion, an international levy on fossil fuels and goods is essential for assisting nations battling the adverse effects of climate change. Multilateral development banks must also increase lending flexibility to help build climate resilience sustainably. There is an imperative to act decisively before additional disasters cement the urgent need for climate financial frameworks that prioritize the most vulnerable populations in our global community.

The topic of climate resilience financing in the context of global warming has gained prominence due to the increasing frequency and severity of climate-related disasters, particularly impacting developing countries. Such nations contribute the least to global greenhouse gas emissions but suffer significant losses due to climate change. Current economic models often lead to rising debts for these countries, requiring innovative funding mechanisms to address loss and damage resulting from climate events. Existing international precedents demonstrate the feasibility of implementing levies to collect funds from those primarily responsible for climate emissions, thus creating a financial safety net for those most affected.

In summary, the taxation of fossil fuels and shipped goods is not only feasible but necessary to create a robust funding mechanism to support those affected by climate change. As developing countries struggle under the weight of climate-related debts, implementing levies could provide substantial financial resources for resilience efforts. A coordinated international approach is crucial to ensure that equitable solutions are developed for those disproportionately affected by climate crises.

Original Source: www.aljazeera.com