The ASCOR study reveals that wealthy countries are falling significantly short in their climate action commitments, not aligning with necessary strategies to limit global temperature rise to 1.5°C. Amidst escalating investor scrutiny and potential legal challenges, most affluent nations lack transparency in phasing out fossil fuel subsidies and providing adequate climate financing. However, some nations like Costa Rica and Angola show potential by nearing their climate targets, highlighting both the promise and challenges ahead.

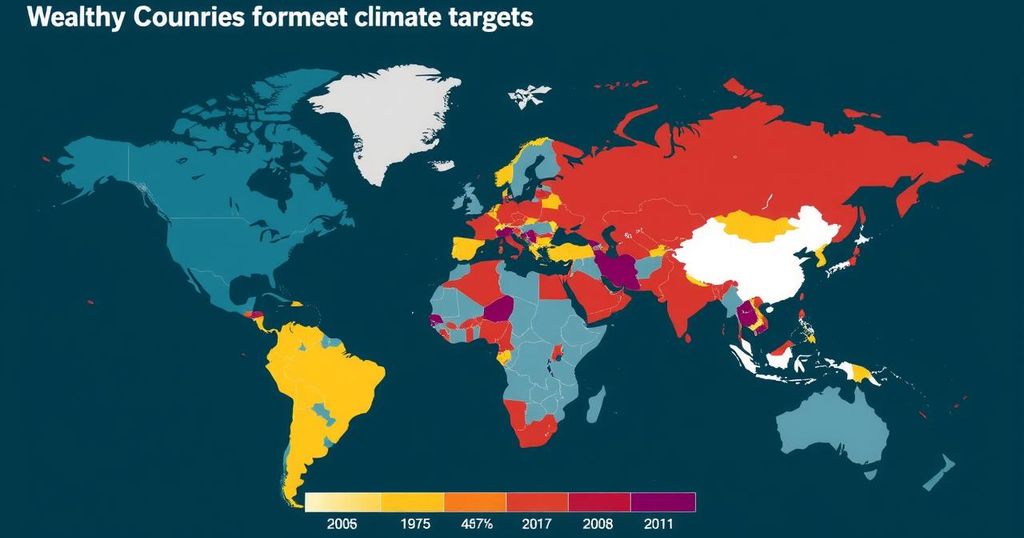

Investors in government bonds are increasingly scrutinizing the responses of wealthier nations to climate change, noting a significant gap between pledged actions and effective contributions to mitigate global warming. A revealing analysis from the Assessing Sovereign Climate-related Opportunities and Risks Project (ASCOR) indicates that affluent countries are not aligned with necessary emission reduction measures for maintaining the global temperature increase below 1.5°C. The study, examining 70 nations, found no clear trend indicating effective strategies among wealthy nations in addressing climate change.

As 2024 is projected to become the hottest year, with global temperatures already reaching levels 1.5°C above pre-industrial levels, the urgent need for action is emphasized. Victoria Barron, Chief Sustainability Officer at GIB Asset Management and ASCOR co-chair, remarked, “Investors need to see more credible action by governments,” highlighting the crucial role of investors in driving capital toward viable climate solutions.

Despite heightened concern, there is a consensus among investors that current financial markets inadequately account for climate change risks. Researchers propose the concept of the “climate-sovereign debt doom loop,” which estimates the potential increase in national debt burdens due to climate-related challenges. Concurrently, legal issues are rising for countries failing to protect citizens from climate-induced disasters, with hearings set to occur at the International Court of Justice next month.

The situation in the United States remains concerning with President-elect Donald Trump’s anticipated withdrawal from the Paris climate agreement and the appointment of a fracking executive to the Energy Department. In Europe, corporate hesitations are testing the resolve of policymakers committed to sustainability amid criticisms of high administrative costs.

However, some nations are showing promise; Costa Rica and Angola are noted for nearing their 1.5°C targets. Notably, less than 20% of countries have pledged to cease new fossil fuel productions, and over 80% lack transparent commitments to attenuate fossil-fuel subsidies. Additionally, climate financing is insufficient, with over 80% of wealthier nations not meeting their share of the annual USD 100 billion climate financing objective, which the COP29 climate summit aims to increase to USD 300 billion.

In light of these findings, ASCOR has broadened its assessment from an initial 25 nations to a comprehensive review of 70 countries to meet the growing demand for reliable climate action frameworks. On a more positive note, 40 nations have established legal frameworks to address climate issues, and three-quarters of them have plans to manage the physical risks associated with climate change.

The report by the Assessing Sovereign Climate-related Opportunities and Risks Project highlights the critical shortcomings of wealthier nations in their climate commitments. As global temperatures continue to rise, the analysis draws attention to the urgency of aligning national pledges with actionable strategies aimed at limiting temperature increases. The increasing scrutiny from investors underscores the financial implications of inadequate climate action, as nations face potential legal accountability for not safeguarding their populations from environmental threats. This context is crucial for understanding the implications of the findings presented in the article.

In conclusion, the ASCOR study underscores a significant failure among wealthy nations to adhere to climate change mitigation commitments, as many remain misaligned with necessary strategies to limit global temperature increases. Despite some countries making progress, the widespread inadequacy of climate financing and the lack of coherent policies remain alarming. The need for credible governmental actions and transparent commitments is urgent, as this affects both ecological sustainability and financial stability on a global scale.

Original Source: www.outlookbusiness.com