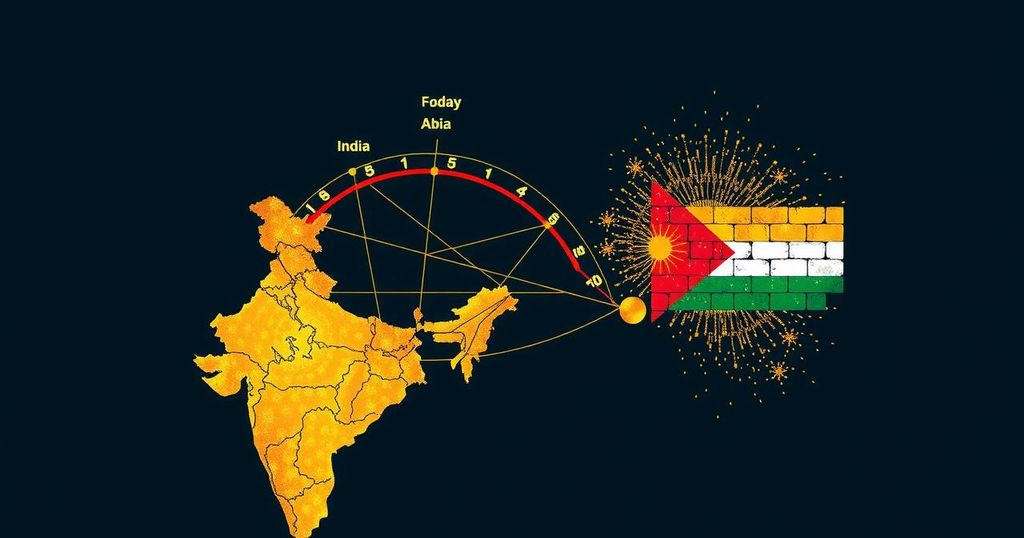

Gold prices in India are currently more affordable compared to those in Oman, Singapore, UAE, and Qatar due to rising geopolitical tensions in the Middle East. The conflict involving Israel has led to increased demand and heightened prices in the region, while global market trends show a decline in gold prices, aligning with India’s falling costs. Recent data indicates a 4.5% drop in U.S. spot prices, illustrating a broader downward trend.

Recent reports indicate that gold prices in India are lower than those in Oman, Singapore, the United Arab Emirates, and Qatar. Shoppers who typically opt for gold purchases at duty-free outlets in the Middle East might find it more beneficial this time to explore local options in India. The discrepancy in prices is largely attributed to escalating geopolitical tensions in the Middle East, notably the conflict involving Israel, which has heightened demand and, subsequently, the prices of gold in that region. In contrast, gold prices in India have seen a downturn aligned with global market trends, reflecting a notable decrease as the yellow metal has experienced its most significant weekly fall in over three years, with recent spot prices in the United States dropping by 4.5%. As a safe-haven asset during periods of instability, gold often gains traction in times of uncertainty. Nonetheless, the recent turmoil has led to inflated prices in the Middle East, compelling investors and buyers to reconsider their purchasing decisions.

The trend of gold pricing is influenced by several factors, including geopolitical stability, demand fluctuations, and global market trends. Recent conflicts in the Middle East, especially involving Israeli aggressions, have created a surge in demand for gold as people seek security in precious metals amid volatility. Conversely, the Indian market is experiencing a decline in gold pricing, which reflects broader global trends of a decrease in gold prices, thereby making it more attractive for consumers in India to buy gold domestically rather than from overseas markets. The current market situation illustrates that gold and silver still hold significant investment value, particularly in uncertain times.

In conclusion, the lower gold prices in India compared to the Middle East reflect both local market dynamics and the impact of escalating geopolitical tensions in the region. Investors may find that exploring local options is more advantageous amid fluctuating prices on the global stage, driven by conflicts in the Middle East. This situation presents an opportunity for Indian buyers to capitalize on relatively cheaper rates, while global trends continue to influence market behavior.

Original Source: www.livemint.com