Analysts express optimism for ReconAfrica’s exploration in Namibia and Botswana, particularly surrounding the Naingopo well, which is nearing completion at 3,500 meters. Estimated reserves indicate potential for significant oil and gas resources, with analysts maintaining positive investment ratings. A 3D seismic survey is scheduled for mid-2025, enhancing exploration prospects.

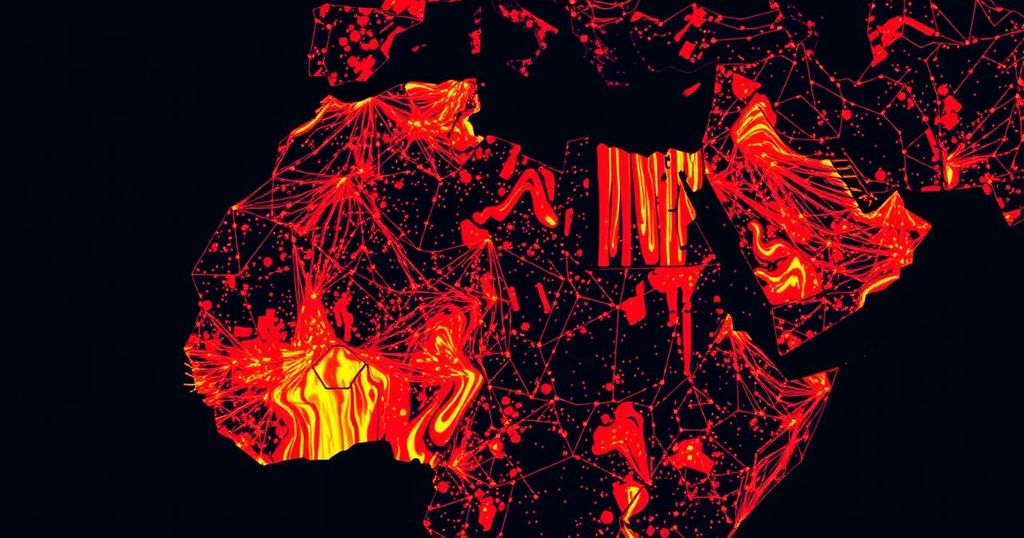

There is mounting optimism among analysts regarding Reconnaissance Energy Africa Ltd (TSX-V:RECO, OTCQX:RECAF) following a recent corporate update concerning their exploration program in Namibia and Botswana. The company’s primary focus is the Naingopo exploration well within the PEL 73 block in Namibia, which has reached a depth of 3,500 meters, advancing toward its target depth of 3,800 meters. Although drilling has encountered minor delays due to equipment adjustments, the conclusion of drilling operations is expected in the near future. Analysts from Haywood Securities indicate that the successful identification of hydrocarbons and the resource’s economic viability could significantly enhance the stock’s valuation potential. The well is said to contain unrisked resources of approximately 309 million barrels of oil or 1.6 trillion cubic feet of natural gas, leading to heightened expectations regarding the company’s future prospects in the region. Furthermore, Research Capital Corporation has estimated that in the event of discovering natural gas, the unrisked prospective resources could be in the range of 937 Bcf or 656 Bcf net. Looking ahead, the company plans to execute Namibia’s inaugural onshore 3D seismic survey, encompassing 500 kilometers over the Kavango Rift Basin, set for mid-2025, marking a significant advancement in its exploration strategy. As the Naingopo drilling approaches its conclusion, results are anticipated shortly, maintaining a favorable outlook for the company’s exploration endeavors. Research Capital Corporation continues to endorse a Speculative Buy rating on the stock, with a target price set at C$2.30. Meanwhile, Haywood Securities has issued a Buy rating, projecting a target price of C$2.10 per share. On the latest trading day, ReconAfrica shares hovered around C$0.97 on the Toronto Stock Exchange.

Reconnaissance Energy Africa Ltd, a resource exploration firm, is actively engaged in drilling operations in Namibia and Botswana. Their flagship project, the Naingopo exploration well, is pivotal for the company’s growth strategy, as it aims to uncover substantial oil and natural gas reserves. The evaluation of hydrocarbon presence in this area is critical not only for the company’s valuation but also for the regional energy landscape. The upcoming 3D seismic survey planned for mid-2025 is essential for further exploration efforts and validation of resource estimates.

In summary, analysts express a bullish outlook for Reconnaissance Energy Africa Ltd due to its ongoing exploration activities in Namibia and Botswana. The developments at the Naingopo well, alongside future seismic surveys, could potentially unveil significant hydrocarbon reserves, thus enhancing the company’s future market position. The current speculative investment ratings reflect the high-risk, high-reward scenario associated with these exploration endeavors, positioning ReconAfrica as a noteworthy player in the resource sector.

Original Source: www.proactiveinvestors.com