This article delves into the newly revealed financial transactions between major oil companies and governments, focusing on Equatorial Guinea as a case study. Highlighting the stark contrast between the wealth generated by oil and the dire living conditions experienced by many citizens, the piece discusses the implications of these disclosures on transparency, tax obligations, and potential corruption in the extractive industry. Furthermore, experts point out the disparaging tax arrangements for U.S. companies compared to their payments abroad, calling for more equitable practices and policies.

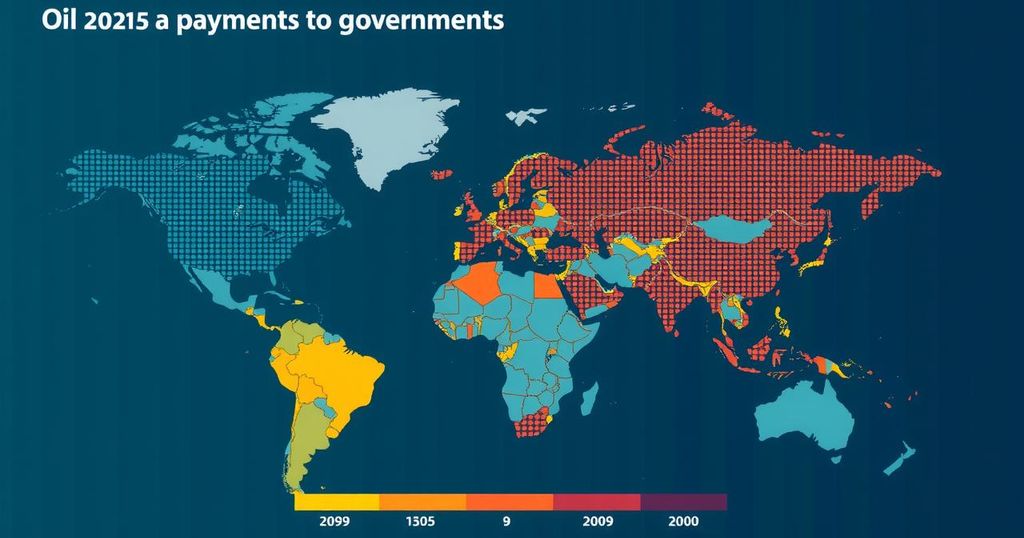

In 1996, Tutu Alicante was a student in the United States, while back in Equatorial Guinea, his sister tragically succumbed to complications from an ectopic pregnancy due to the poor medical conditions. This incident occurred a year after Mobil discovered oil off the coast of Equatorial Guinea, leading to significant economic growth yet failing to improve healthcare and living standards for many citizens. Alicante, now the executive director of EG Justice, a nonprofit organization aimed at addressing corruption in Equatorial Guinea, recounts this tragic history during a recent webinar discussing groundbreaking disclosures from oil companies regarding their financial transactions with governments worldwide. These disclosures, required under U.S. securities regulations, reveal that companies like ExxonMobil and Chevron collectively paid tens of billions of dollars last year to various governments, including substantial sums to the Equatoguinean government. Specifically, ExxonMobil reported $189.2 million in payments to Equatorial Guinea, while globally, it paid $32 billion across 28 countries. Meanwhile, Chevron disclosed payments of $16.6 billion across 17 countries. Alicante highlighted that for many Equatoguineans, the figures discussed represent matters of life and death, contrasting the exorbitant wealth of elites with the dire conditions experienced by the impoverished. The newfound data allows citizens to scrutinize such payments against government reports, potentially uncovering instances of corruption. One notable finding from these reports reveals a disturbing trend regarding tax payments where U.S. companies pay significantly lower taxes domestically compared to their obligations in other countries. For instance, although Exxon generated a significant portion of its U.S. oil and gas output, it paid about five times more in taxes to the United Arab Emirates. Chevron similarly reported higher payments to certain countries despite the majority of its production being based in the United States. Despite claims that meaningful cross-country comparisons are difficult to draw due to differing tax structures, some experts assert that these disclosures can spark necessary conversations regarding the fairness of tax arrangements and the revenue losses incurred by the U.S. government. Zorka Milin, a policy director from the Financial Accountability and Corporate Transparency Coalition, suggested that even without detailed contractual disclosures, the tax data holds potential for revealing inequities in company payments relative to state and local taxes. Concerns have also been raised regarding the global impact of extractive deals, as many low-income countries are also receiving unfavorable terms in their agreements with multinational corporations. Simon Taylor, co-founder of Global Witness, characterized many concessions as predatory, significantly benefiting the corporations at the expense of the states involved. The impetus for these disclosures traces back to the 2010 Dodd-Frank Act. While the regulatory landscape has experienced various challenges over the years, the importance of transparency regarding energy sector payments to governments could provide a pathway for accountability and reform. This transparency is particularly crucial as nations globally commit to reducing fossil fuel reliance and seek equitable energy transition policies.

The article serves as an exploration into the ramifications of oil company payments to governments, specifically in the context of Equatorial Guinea’s economic landscape. It sheds light on the severe disconnection between the wealth generated from natural resources and the living conditions of ordinary citizens in oil-rich countries, emphasizing the need for greater accounting and transparency in corporate transactions with governmental bodies. The background also includes the historical context of the Dodd-Frank Act and the ongoing discussion regarding corporate tax obligations, pushing for reforms that may lead to a more equitable distribution of oil revenue and proper use of funds.

In conclusion, the recent disclosures by major oil companies concerning their payments to governments reveal profound discrepancies in tax obligations between the U.S. and foreign nations, raising questions about the fairness of these arrangements. Additionally, the revelations highlight the dire living situations in resource-rich countries such as Equatorial Guinea, underscoring the imperative for transparency and accountability in corporate dealings. As stakeholders consider reforming tax policies, the insights garnered from these reports may catalyze essential discussions regarding equitable resource management and the welfare of affected communities.

Original Source: insideclimatenews.org